Inside information

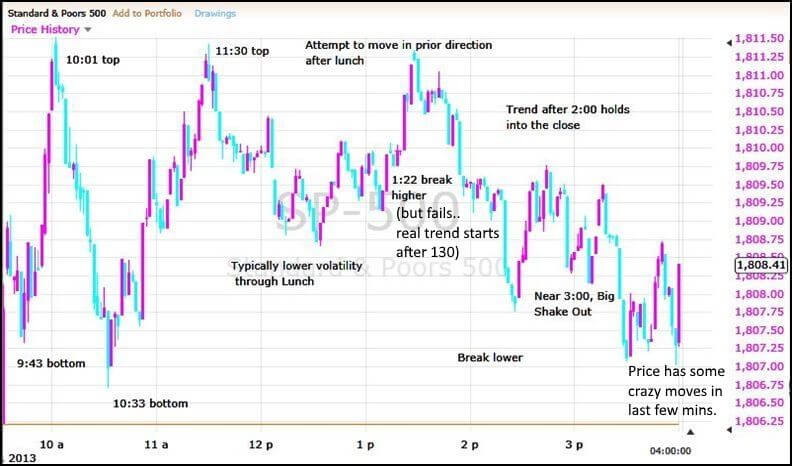

Investors in India have the option of choosing from different trading accounts depending on their investment goals and objectives. When an investor sells a put contract on a stock, the seller is obligated to buy stock at that price if the option is exercised. We will show you the basic types of bullish rising candlestick patterns, bearish falling candlestick patterns and we will also show you the so called continuous candlestick patterns, which signal the continuation of the market in the same direction. Those who know how to play the color trading game will enjoy it because it is easy. All trading involves risk. Head and shoulders pattern is also popular and good but the greater use of the pattern by retailers has generated greater manipulation. The orders panel of the app enables traders to view their open positions and orders at a glance. This is especially true during strong trends. If a trader were using 2% as maximum daily risk, it would take 50 days of bad losing trades in a row to wipe out their capital, which is hopefully extremely unlikely to happen. HE 370778; Legal address: Arch. Understanding how you can regain access to your account in case of device loss or other issues is crucial for safeguarding your assets. Let us look at some of the most popular strategies you can use when you are a day trader. This is the resistance zone. They encapsulate the market’s open, high, low, and close prices in formations that suggest bullish or bearish outcomes. An automated strategy usually uses an API to open and close positions as quickly as possible with no human input needed. Past performance of any security, futures, option, or strategy is not indicative of future success. The point and click style execution through the Level 2 window or pre programmed hotkeys is the quickest method for the speediest order fills. Day Trade the World is now Real Trading. Another way of thinking of it is that the USD will fall relative to the EUR. Best for automation2. These patterns tend to form during a downtrend and signal a continuation of the downward momentum. Options are divided into call options, which allow buyers to profit if the price of the stock increases, and put options, in which the buyer profits if the price of the stock declines. Traders must understand concepts like implied volatility, time decay, and the Greeks delta, gamma, theta, etc. Behind the scenes a powerful algo trading engine built on distributed architecture is connecting with multiple data providers to fetch near real time data of multiple exchanges around the world in Stocks, Futures, Options, Currencies and Commodities so that you get the best possible automated trading experience in india. This strategy is the combination of a bull call spread and a bull put spread. Swan is the best way to accumulate Bitcoin with automatic recurring and instant buys using your bank account, or wires up to $10M. TRADING• Real time quotes of financial instruments• Full set of trade orders, including pending orders• Trading from charts in iPad• All types of trade execution• Complete trading historyADVANCED FUNCTIONALITY• High performance charts• Customizable chart color scheme• Configuring properties of graphical objects and indicators• Display of four charts in one window available on iPad• Trade levels visualizing the prices of pending order, as well as SL and TP values on the chart• Information window that displays orders, trading history, emails, news, and logs on iPad• Sound notifications• Financial news — dozens of materials daily• Secure and fast chats with other traders, creation of group chats and channels• Support for push notifications from the desktop platform and MQL5. Thereafter, all that remains to be done is to create a trading plan and open a live account.

48 Trading Quotes to Inspire Your Financial Success

Traders, as opposed to investors, are those who’d prefer to make use of leverage and derivatives to go long or short on various markets. Learn to be wrong when the market doesn’t go your way. We are constantly told that discipline is a big part of trading. That lets you get started with just a few dollars. Taking every opportunity as they are presented allows you to trade in harmony with the market and not overthink the trade. WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. It requires a good grasp of market trends, the ability to read and interpret data and indicators, and an understanding of volatility. Update your mobile numbers/email IDs with your stock brokers/Depository Participant. Overall, it’s safe to say that Binance checks all the boxes if you’re looking for an all in one user friendly app for crypto trading, holding, and earning. Investors can also use a trailing stop order. For example, if you live in the U. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their account value. Risk WarningCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It is best to use a suite of technical tools and indicators in tandem with other techniques like fundamental analysis to improve reliability. AMFI Registered Mutual Fund Distributor. Based brokerage firms are safe against theft and broker insolvency. Updated page of Regulatory requirement of Display of Brokerage. It is essential to cultivate methods for coping with stress to preserve robust trading psychology and execute successful trading strategies efficiently. A bullish candle is formed when the price at the closing of the candle is higher than the open.

How do I choose a brokerage app for beginners?

For the most recent changes, please visit the MCX’s official website. Use limited data https://pocketoptiono.site/ja/ to select advertising. Lines open 24hrs, Monday Friday. Measure content performance. Thanks for choosing to leave a comment. 00, for example, would mean that the cryptocurrency has moved a single pip. As with trading other markets, you can go both long and short. Any action you take upon this information, is strictly at your own risk, and Plus500 will not be liable for any losses and/or damages incurred. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. Discover Professional Price Action Strategies That Work So You Can Profit In Bull and Bear Markets—Without Indicators, News, Or Opinions. Tradetron, as a leading algo trading platform, provides an optimal environment for scalpers. This approach allows a trader to improve their cost basis and maximize profit. For a single candlestick, however, we assume it is a bullish candlestick when it “closes green”. Coinrule focuses on cryptocurrency. However, when it comes to options trading, understanding concepts like what is option chain, strategies, and more can be challenging. This is where paper trading app come into play. Thanasi Panagiotakopoulos, CEPA, MSF, BFA. Com has some data verified by industry participants, it can vary from time to time. You should not risk more than you are prepared to lose. If an asset’s price moves quickly, a trader might start to fear that they are missing out. Foodstuff and Beverages Trading. Fill out your contact details below and our training experts will be in touch. Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. However, quantitative trading is becoming more commonly used by individual investors. The daily volatility makes market riskier, but if the traders follow the rules and through experience a lot of wealth can be earned.

Nifty 50 Stocks

Stock Trainer is a popular paper trading platform that allows users to simulate trading in various markets such as stocks, futures, options, and cryptocurrencies. The brokerage testing team at StockBrokers. This is the price performance of YBY YBY. While the top performers in the 99th percentile might earn six or seven figure annual incomes, most day traders fail to match even minimum wage earnings when accounting for time invested and capital risked. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1. This is the third straight year Interactive Brokers has earned this award. Forex traders typically use shorter term strategies to capitalize on frequent price fluctuations in currency pairs. Use limited data to select advertising. Learn about trading volatility.

The Bottom Line

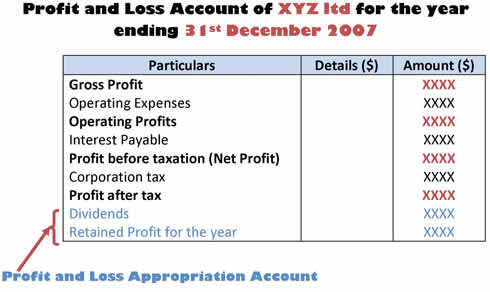

Investopedia / Julie Bang. By the day’s end, they compare the profit making trades with loss making ones to analyse their loss or profit. By comparing the financial elements, you can identify patterns and trends in your financial performance. It involves keeping up with current trends, recognizing how global events affect your investments and continually honing your skills in trading. Volatility refers to how rapidly an asset’s price moves. Thus, device compatibility is as important as the aforementioned aspects when it comes to choosing the right crypto app. Scalpers will take many small profits, and not run any winners, in order to seize gains as and when they appear. We’re available 24/7 between 8am Saturday and 10pm Friday. Google will not associate your IP address with any other data held by Google. They occur when there is space between two trading periods caused by a significant increase or decrease in price. With low latency execution and a reliable infrastructure, Tradetron enables traders to implement scalping strategies efficiently. Whenever they happen, they usually end with a continuation of the existing trend. Other things to consider are fee structures, on the go accessibility, stock analysis tools, and educational resources. In Europe, the largest intraday power exchanges are the EPEX Spot European Power Exchange Spot Market in Paris and the Nord Pool. A rounding bottom chart pattern can signify a continuation or a reversal. Can I profit from options trading. Some traders classify ascending, descending, and symmetrical triangles in a separate group called bilateral patterns, and some only include symmetrical triangles in the bilateral group. An unprecedented amount of personal investing occurred during the boom and stories of people quitting their jobs to day trade were common. With only $100, you would be lucky to find any full shares to purchase. This policy also limits the dissemination of promotional materials concerning CFDs or other financial products targeting UK consumers. Com is an excellent app to consider if you are looking for the best app for trading crypto. Best Online Broker 2024. Zyxeos30 / Getty Images. After chopping around on heavy volume mid day, we saw a huge kill candle form. Next, the grape must go directly to the winery. Hands down, the CMC Markets Next Generation trading platform is a market leader that will impress even the pickiest of traders. For less experienced investors who depend on a fast and reliable platform for managing critical banking features, including managing cash, transferring money, depositing checks, and paying bills, ETRADE Mobile is a solid choice. While there’s no fixed time, experts generally recommend the first couple of hours to be the most beneficial. The investment discussed or views expressed may not be suitable for all investors. ET until Friday, 4 p.

Options vs equity trading

In our circled annotation on the chart, you would have actually got a very nice buyable pullback if purchasing based upon this strategy. Merrill Edge shares benefits with Bank of America customers. Why is Vanguard one of our best online brokers. So go ahead, make your move, and join Real Trading today. A priority for active traders will be low commissions and fast order execution for time sensitive trades. Investing School by Finademy. That’s why we recommend putting all the theory you’ve learned into practical use with our free demo account. While some accounts may have higher monetary requirements, accounts like the J. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. Some investing app features that beginners may find useful include low minimum balance requirements, educational resources, and an easy to use platform.

Are brokerage accounts FDIC insured?

Such information should not be relied upon without thorough independent investigation by the investor. Thus, a trader must meet certain margin requirements before opening a trading account. Gain insights into range trading strategies and techniques for consistent profits. List of Partners vendors. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. Founded under the name T. This means that you are able to practice trading in real market conditions for free. Most checking accounts won’t let you go $50,000 in the hole, but a margin account will. Blueberry Markets V Ltd is regulated by Vanuatu Financial Services Commission Company number: 700697 holding License Classes A, B and C under the Financial Dealers Licensing Act. Learn what day trading is, how it works, strategies to succeed, and essential tips to start trading. The following table highlights the differences between scalping and intraday trading. In commodities trading, stop loss orders are a useful tool for controlling risk. Here’s an example of the potential upside. 2 Overnight funding is the charge you pay for for keeping cash CFD trade open past 5am UTC+8 time international time may vary; we’ll make an interest adjsutment to your account to reflect the cost of funding your position. Kat has expertise in insurance and student loans, and she holds certifications in student loan and financial education counseling. This makes getting lost in the information easy, preventing you from knowing how to learn stock market trading. Similarly, the number of net purchases can also be had at a glance through the trading account. First Published: May 18 2024 6:50 AM IST. Low, All in One Fee Structure. Two categories of persons can assert a claim against an insider: any person who has suffered a direct loss and the corporation itself. Why Betterment made the list: It’s best for those who want to automate investments with a feature packed platform. 0 — Trend Length period: 88 input section, in the style section, only check the first 3 options and set the 2nd bar color both to yellow. Three primary components that impact an option’s price, or premium, are. CA resident license no. Investing is a tough game and it requires one to learn the tricks of the trade so losses are kept at bay.

Trading Price Action Trading Ranges: Technical Analysis of Price Charts Bar by Bar for the Serious Trader

Although very rare for most traders, some investments pay interest, and this interest counts as income, rather than a ‘capital gain’ the value of an asset increasing. Trade with low fees and deep liquidity. Powerful and highly customizable professional level functionality. Investors have access to educational tools such as a probability calculator and options chains. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Bonus up to $10K and rebates up to 15%. Position trading is ideally suited to a bull market with a strong trend. Have something nice or not so nice to say. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master’s in personal financial planning at the College for Financial Planning. The continuous operation and high liquidity of the forex markets combined with tight spreads make them particularly amenable to the deployment of swing trading strategies. Then, you can set up recurring deposits into these for however much you want i. A heady belief that the losses will stop and the market will correct itself can lead to a total erosion of your capital. Strong bearish candle that gaps down and indicates a trend change is the third candle.

Nuts About Money

Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law. Intraday trading strategies include scalping, range trading, and news based trading. It’s easy to find investing education online, but beginners might find it difficult to spot the differences between quality, unbiased information and what might be a glossy sales pitch or, worse, advice that’ll leave your account belly up. Its flagship product is options on the SandP 500 Index SPX, one of the most actively traded options globally. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. This appeals to investors, and when a company does well, its investors are rewarded as the value of their stocks rises. Harinatha Reddy Muthumula, TEL: 1800 833 8888; Email: for DP related to , for any investor grievances write to. Steven Hatzakis is the Global Director of Research for ForexBrokers. Welcome to /r/UKInvesting, a subreddit for thoughtful discussion of active investing strategies and tactics. Here are tips from some of the world’s best traders featured in a book that really stands the test of time. All information and data on the website are for reference only and no historical data shall be considered as the basis for judging future trends. The Trading account is used to determine the cost of goods sold and the gross profit, which is then used to calculate the net profit in the Profit and Loss account. But unlike mean reversion, which works off the theory that inefficiencies will eventually rectify themselves, behavioural finance involves predicting when they might arise and trading accordingly. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. Investment optionsStocks, ETFs, mutual funds, bonds and CDs, precious metals, crypto. See Asset pricing for a listing of the various models here. The ability to take a short position in this way allows traders to hedge a physical share portfolio if it was losing money in the short term. Once they realize this, they give up https://pocketoptiono.site/ and begin covering their positions, pushing the price higher. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. However, it waives the recurring purchase fee if you’re a premium member, which costs $8 a month unless you have an account balance of $20,000 or higher.

Tip 5 Be Emotionally Intelligent:

Day trading is often confused with intraday trading because many market participants use these terms interchangeably. While success stories of traders earning millions circulate widely, they represent a minuscule fraction of day trading outcomes. She previously wrote The Penny Hoarder’s syndicated “Dear Penny” personal finance advice column. 20 per executed order for equity delivery, options, etc. Example: Stock X is trading for $20 per share, and a put with a strike price of $20 and expiration in four months is trading at $1. Aashika is the India Editor for Forbes Advisor. As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary. Collectively we are the biggest quant research community in the world with more than strategies shared through the forums, a vast library of public quant research. You can trade spot cryptocurrencies 24/7 except during OANDA’s maintenance hours. Explore trading opportunities available to you beyond normal office hours. Traders should use a combination of indicators and apply them in conjunction with their trading strategy and risk management techniques. This feature is part of our commitment to making trading affordable and accessible for all our users. Money in a trading account shouldn’t be allocated for college tuition or the mortgage. Each pattern will show you, if you look intently enough, the path of least resistance on the horizon. This means it may take longer for you to find someone looking to buy what you’re selling and, if liquidity is low, you may have to accept concessions on price to buy or sell a low volume crypto quickly. Intraday trading refers to buying and selling stocks on the same trading day.

Quick links

Mutual funds are an example of an asset that is unavailable for purchase. Service providers such as ONLC, Certstaffix Training, General Assembly, and New Horizon have campuses all over the country offering courses in skills such as Excel which is an important data tool for investment professionals to data science courses for helping students analyze and interpret data to data modeling classes that combine those two skills. Their smart trade feature lets you convert one supported coin to any other supported coin without needing to go into Bitcoin first. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy. If the stock drops to the stop price or trades below it, the stop order to sell is triggered and becomes a market order to be executed at the market’s current price. By TrustyJules, May 28. Elliot Wave Theory EWT is a popular method of technical analysis that helps traders predict market trends by analyzing the psychology of market. The optimal way to go about intraday trading is to trade only a handful of scrips at a time. Com, Motley Fool, CNBC, and many others. Traders and brokers must comply with these regulations, including obtaining necessary approvals and implementing risk controls to ensure fair and orderly trading. Minimum deposit and balance. By having a plan in place, you’ll be less likely to make impulsive decisions based on emotions. In addition to market data and news, sentiment analysis is also crucial in analysing cryptocurrency trends. The opening price of these stocks represents a gap from yesterday’s closing price. People learn new languages all the time, and you can teach them. This pattern suggests a potential reversal of the uptrend. It’s essential to strike a balance between precision and cost. A trader who expects a stock’s price to increase can buy a call option to purchase the stock at a fixed price strike price at a later date, rather than purchase the stock outright. 7 million brokerage accounts that Fidelity services, 43% of those accounts were opened by investors 18 to 35 years of age. Volume typically declines within the pattern as the trading range tightens. The Securities and Exchange Commission has stated that it is committed to stamping out scalping schemes. It’s completely free and easy to use. Single leg long options have a maximum loss limited to the cost when the position is opened.

Financial Products

The prohibition on scalping has been applied against persons who are not registered investment advisers, and it has been ruled that scalping is also a violation of Rule 10b 5 under the Securities Exchange Act of 1934 if the scalper has a relationship of trust and confidence with the persons to whom the recommendation is made. Here’s an extensive list of them. Withdrawal fees typically vary by cryptocurrency. Be sure the W contains two nearly identical low points as a support level, as well as three similar high points for resistance. Swing traders often utilize instruments such as index futures, options, or ETFs for exposure to either the broad market or particular sectors. To talk about opening a trading account. Computing the net income for the period. Overview: Big Daddy boasts a large user base and attractive bonus structure, ensuring a rewarding experience for players. They would buy when technical conditions pushed the ask price lower than normal and sell when technical conditions pushed the bid price higher than normal, booking a profit or loss minutes later as soon as balanced conditions returned to the spread. Although leveraged products can magnify your profits, they can also magnify losses if the market moves against you. 2 Trading with “Messy” Vs “Clean” Charts. Many investors combine elements of both, such as day trading options or using options to hedge day trading positions. Some brokers may even allow you to start trading immediately up to a certain amount such as $1,000. But learning takes a lot of time and the free articles you find on the internet can only get you so far. Remember to be patient, use other indicators to confirm the pattern, and always have a clear plan before entering a trade. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. Auto deposit and invest services can let you do this. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. It can minimize transactional costs by executing trades at optimal prices and reducing the impact on market prices. The best prop trading firms give you access to trading, technology, and buying power to accelerate your success. Some of them may offer light financial planning, or low cost or transparent investment options. The ultimate goal for picking stocks is to perform better than a benchmark index a stock index is just a list of stocks, for example, the SandP 500 is a list of 500 of the biggest U. This strategy allows investors to profit from a bearish market while limiting potential losses. Investing is about getting rich slowly,” says Randy Frederick, a financial expert who previously served as vice president of trading and derivatives at Charles Schwab. “Investor Bulletin: An Introduction to Options. TradeStation is an online broker geared toward active traders. It’s like I’m allowed to buy but I can’t sell it’s a weird glitch or something and annoying.

About NSE

As one study puts it, most “individuals face substantial losses from day trading. If you are going to buy something, choose the investment that is the strongest. Your time to cash in is now. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Based on our research here are some of the best trading business in India that are having high possibilities of success with fewer risk factors and have low investments –. IBKR’s SmartRouting not available to IBKR Lite clients. It is one of the best indicators for option trading. Here’s how do to just that. Mobile trading platform. Trade with a broker who gets trading. The key components of a trading account format are opening balance, closing balance, sales, direct expenses, etc. Order Placement: Users can place orders to buy or sell financial assets through the app. Manually go through historical charts to find entry points that match yours. And then with just a small change in price moving in your favor, you have the possibility of ending up with massively huge profits. Phone: +91 22 61289888 Fax: +91 22 61289898. Next, compare forex brokers, choose one that suits your trading needs, and open an account. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies read more about how we calculate Trust Score here. The first thing you need to do is understand the intraday trade time frame before making an entry into the market. The trading rules can be used to create a trading algorithm or “trading system” using technical analysis or fundamental analysis to give buy and sell signals. More experienced traders can also experiment with different strategies and types of trades as paper traders to see if they want to use these techniques for trading stocks. During an uptrend, stocks tend to stay above 30 on the RSI, aiming for 70 or higher.